Central Asia and the Global Economic Crisis

Download “Central Asia and the Global Economic Crisis”

EUCAM-Policy-Brief-7.pdf – Downloaded 412 times – 589.41 KBIntroduction(1)

In 2007 the EU published a Strategy for a New Partnership with Central Asia. In its initial stages the EU focused on developing new forums for dialogue with the Central Asian countries, and received some criticism for inadequate substantive actions. This Policy Brief argues that the current global economic crisis does not alter the priorities of the EU Strategy, but it does require the EU to stick to existing obligations and also provides an opportunity for fresh initiatives to better achieve the Strategy’s fundamental goals.

A striking feature of the five Central Asian countries’ economic strategies is that they followed divergent paths after becoming independent in 1991. Despite strong similarities in culture, history and economic structure, their transitions from Soviet central planning ranged from the most rapidly liberalising (the Kyrgyz Republic) to the most non-reforming (Turkmenistan) of all former Soviet republics. By the turn of the century, when the transition from central planning was essentially completed, the Central Asian countries had created vastly different economic systems. These differences had important implications for economic stability during the 1990s, for long-term growth prospects in the 2000s, and for the impact of the global economic crisis that gathered pace in 2008-9. The Central Asian countries are open economies in the sense that international trade is important, but they have all been suspicious of integration into the global economy and have embraced globalisation to varying degrees. In general terms, the more globally integrated an economy is the better its performance was over the last two decades, but the more exposed it was to crises.(2) In Central Asia this generalisation needs to be more nuanced; and Section 2 relates it to country-specific resource endowments and economic strategies.

The main implication for the EU Strategy is that what was desirable in 2007 is still desirable. Goals of strengthening human rights, rule of law, good governance and democratisation may be harder to achieve in straitened circumstances, but success is connected to the economic goals of promoting economic development, trade and investment and alleviating poverty. Finally, the Strategy’s goal of strengthening energy and transport links may be easier in a period of low energy prices as long as the EU can turn the economic downturn into an opportunity rather than a threat.

1. The Central Asian Economies(3)

During the 1990s the Kyrgyz Republic was one of the leading reformers among former Soviet republics, inter alia the first to join the World Trade Organisation. Kazakhstan was also active in creating a market-driven economy. Both of these countries experienced disappointing economic performance over the decade, and just as they were emerging from the transitional recession both economies were severely hit by the 1998 Russian Crisis.

Uzbekistan and Turkmenistan were more cautious reformers. Gradualism was a good short-term strategy to minimise disruption from the end of central planning and the dissolution of the USSR. As the two largest cotton producers in the Soviet Union, both countries benefited from the ease with which cotton could be shipped to global rather than CIS markets and from buoyant world cotton prices in the first half of the 1990s. Uzbekistan was the best performing of all former Soviet republics during the 1990s, with the smallest decline in GDP and reasonably good social indicators. Turkmenistan, with a more autocratic leadership and negligible reforms, fared less well, despite revenue from cotton and gas exports, because the domestic economy was woefully inefficient.

Racked by civil war for most of the decade, Tajikistan’s economic transition fell between these two pairs. The collapse of institutions led to rapid de facto privatisation, but limited the emergence of a well-functioning market economy. Tajikistan was a substantial exporter of cotton and aluminium, based on its hydroelectricity potential, but control over these key goods fluctuated in the civil war and maintenance of infrastructure such as irrigation systems was neglected.

By the start of the 21st century the five countries had differing potential for sustained growth. Uzbekistan in 1996 and Turkmenistan in 1998 implemented stringent foreign exchange controls after their export earnings declined due to falling world cotton prices, exacerbated in Turkmenistan’s case by poor revenues from gas sales. The controls were symptomatic of suspicion of the price mechanism, and of a ‘vent for surplus’ view of foreign trade by which production of cotton and gas beyond domestic needs would be exchanged for imported goods. Trade was not part of a development strategy, and both countries promoted import-substituting industrialisation.

The negative consequences of these policies were recognised by Uzbekistan, but once in place they were hard to change because key individuals and groups benefited from exchange controls and barriers to imports (e.g. the state was able to manipulate prices to obtain a large share of cotton rents and owners and workers in inefficient industries were sheltered from competing imports). The controls were only gradually relaxed over the first decade of the 2000s. Consequently, Uzbekistan’s economy grew sluggishly and in the face of growing discontent, the regime became more repressive – an outcome highlighted by the demonstrations and deaths in Andijan in 2005.

In Turkmenistan the response of President Niyazov, or Turkmenbashi the Great as he preferred to be known, was to retreat into autarchy. The approach was underpinned by the rise of world oil prices after 1998 which, with a time lag, filtered through into higher prices for Turkmen gas exports. The pipeline system continued to leave Turkmenistan dependent on Russian demand, but as the price paid by the EU for Russian gas soared, Russia was keen to ensure supplies of Turkmen gas for its own customers. Turkmenbashi’s only international trip in the last years before his death in December 2006 was to China, driven by a desire to diversify gas export routes. More active foreign policy has been a keynote of the early years of the presidency of Gurbanguly Berdymukhamedov, Niyazov’s successor, with promises of increased gas exports to Russia, China and the EU, but the seriousness of these commitments and of pronouncements about economic reform are still to be tested.(4)

Kazakhstan and the Kyrgyz Republic were better placed for sustained growth over the last decade because central planning had been replaced by better functioning market-based economies than in Uzbekistan or Turkmenistan. However, their relative economic fortunes would be dominated by energy market developments.

Kazakhstan’s recovery from the 1998 crisis, with a large devaluation stimulating export growth in 1999, was overshadowed by oil exports. Kazakhstan’s huge oil reserves in the Caspian Basin were finally starting to flow in large quantities. The first alternatives to the Russian Transneft pipeline were being constructed, and oil prices were starting a climb from under $10 a barrel in 1998 to a peak of almost $150 in 2008. Kazakhstan was one of the fastest growing economies in the world in the decade starting in 1999. The oilboom fuelled confidence, government spending, a credit boom and an asset bubble centred on construction in the two main cities, Almaty and Astana. The financial sector, already the most dynamic in Central Asia became internationalised as banks sought funds from abroad to meet the insatiable demand for credit domestically.(5) Signs of a banking crisis started to emerge in 2006 and 2007, before the global crisis but with similar roots to the US sub-prime crisis (i.e. over-exuberant borrowing and lenders paying less and less attention to borrowers’ creditworthiness or the value of collateral).

In the absence of hydrocarbons or other major exportables apart from a single goldmine, the performance of the Kyrgyz economy was weaker, and the political situation was plagued by uncertainty. All of the Central Asian countries have established super-presidential regimes, but parliament is least weak in the Kyrgyz Republic. Moreover, alone among the Central Asian countries, the Kyrgyz Republic has experienced a political succession not associated with civil war or bereavement. Nevertheless, the domestic political situation remains unstable, with rampant corruption and a disappointing economic performance. Internationally, Kyrgyzstan has been the most consistently pro-Western of the countries and hosts the last remaining US base in Central Asia, although at the time of writing the base’s future is limited.(6) Northern Kyrgyzstan is increasingly economically dominated by its richer neighbours to the north, with many workers migrating to Kazakhstan or Russia and a financial system dominated by Kazakh banks since the 1998 crisis.

For Tajikistan peace and the authority of the central government were established between 1997 and 2001, but many institutions remain weak. A huge percentage of the male population works abroad, mainly in Russia, and remittances are the country’s major source of foreign exchange; although data are sketchy, the share of remittances in GDP is perhaps the highest in the world.(7) The resident population remains desperately poor.

2. Globalisation and Central Asia

The Central Asian economies are open but they are not integrated into the global economy in particularly complex ways. Kazakhstan as the richest and most developed economy in the region has the most complex relations to globalisation, but even there suspicion of losing autonomy (reflected in the slow progress of WTO accession negotiations) has limited the degree of globalisation of the Kazakhstani economy. The main channels of globalisation, and hence for contagion from the global economic crisis, run through (A) the financial sector, (B) trade, and (C) migration and remittances. The last is important because hundreds of thousands of workers from Tajikistan and to a lesser extent the Kyrgyz Republic and Uzbekistan are working abroad and their prospects will be directly influenced by economic conditions in Russia and elsewhere.

2.1. Finance

Over the last decade Kazakhstan’s economy has been the success story of Central Asia. Among the jewels of the marketdriven economy have been the banks, sometimes claimed to be the most efficient in the CIS, and expanding first into the Kyrgyz Republic, where over 70% of the assets of the banking sector are Kazakh-owned, and more recently into Tajikistan. Kazakhstan’s banks became increasingly integrated into global financial markets. As Almaty and Astana in the mid- 2000s experienced a real estate boom, banks lent to borrowers eager not to miss out in the property market and as demand for credit outran domestic savings the banks borrowed in international markets. By 2006, Kazakhstan’s banks were raising large amounts of capital abroad, where the cost was less than the double-digit interest rates that they could charge borrowers at home. In the first half of 2007, medium- and longterm debt-creating capital inflows more than doubled, largely due to external borrowing by the banking sector. The maturity mismatch between the foreign assets and the banks’ loan portfolios caused problems when the foreign institutions began to worry about Kazakhstan’s external obligations and when loosening of the exchange rate peg caused domestic banks to reassess their foreign currency exposure.(8)

In 2007 Kazakhstan’s banks started to compete in making deposits more attractive and substantially increased the interest rates on loans, which by year’s end had reached about 20%, double the rates of two years’ earlier. In November 2007, the government provided support of around $4 billion, targeted at construction projects in danger of being abandoned half-finished, and the central bank raised the official refinancing rate, which had been unchanged at 9% since July 2006, to 11%.(9) In late 2007, Standard and Poor’s downgraded Kazakhstan’s sovereign debt to BBB – the lowest grade above speculative.

By 2008, Kazakhstan’s financial sector problems were coinciding with the emergence of a global financial crisis, but the origins of the domestic financial crisis were home-grown. The banks’ problems arose from loan portfolios overweighted in domestic real estate projects, not from buying over-risky financial assets in the global market. Kazakhstan’s banks had been borrowers in the global financial markets rather than investing in toxic assets coming out of the US financial system. Moreover, although the banking crisis will have substantial economic costs, they are not unbearable because the authorities are well-placed to finance an economic stimulus using the earnings accumulated during the 1999-2008 oilboom.

The financial sectors of the other Central Asian countries are even less exposed to turmoil in global financial markets. The Kyrgyz financial sector is dominated by Kazakh banks, so its financial sector worries are largely tied to Kazakhstan’s. The banking sector in Uzbekistan is dominated by state banks which are conservative in their international activities. Turkmenistan’s financial sector is even more repressed and the only significant transactions are processing revenues from gas and cotton exports and transferring remittances. Tajikistan is too poor to have an internationally integrated financial sector beyond transferring remittances.

2.2. Trade

The Central Asian countries have high export/GDP ratios (see Table 1), except for Tajikistan whose ratio would be much higher if exports of labour services were included (remittances are guesstimated to be equal to about a third of GDP). Despite efforts to diversify their economies by using revenues from energy, mineral or cotton exports or through import-substituting policies or other measures, the Central Asian countries’ exports remain heavily concentrated in a small number of commodities.

Table 1. Openness and Major Exports

| Exports/GDP % | Major exports | ||

| 2006 | 2007 | ||

| Kazakhstan | 51 | 59 | Oil, minerals, iron and steel,grain |

| Kyrgyz Rep | 42 | 45 | Gold, cotton |

| Tajikistan | 23 | 21 | Aluminium, cotton |

| Turkmenistan | 72 | 63 | Gas, cotton |

| Uzbekistan | 38 | 40 | Cotton, gold, gas |

Source: World Bank World Development Indicators at www.worldbank.org (accessed 27 April 2009).

The commodity concentration of exports is high in all five countries, although it fluctuates as world prices change and, especially in Tajikistan’s case, due to volatile quantities. For Kazakhstan, oil accounted for over 60% of exports by the height of the oilboom, up from just under 40% in 1999, when grains, various minerals and iron and steel products were all major export items. Turkmenistan’s data are non-transparent, but natural gas and to a lesser extent oil have come to almost totally dominate exports as cotton production declined. Gold and cotton fibre account for about 45% of Kyrgyz exports. Cotton fibre, gold and natural gas accounted for 68% of Uzbekistan’s exports in 1999 and, despite efforts at export diversification, their share has remained over 60%. Over 80% of Tajikistan’s exports in 2004 consisted of aluminium and cotton, but the output of both commodities varies substantially from year-to-year.(10)

Thus, apart from demand for migrant labour, the primary channel through which the global financial crisis is likely to hit Central Asia is through reduced demand for key commodities and this impact will be country-specific. In 2008 and early 2009, the impact has primarily been felt by the energy exporters, Kazakhstan and Turkmenistan. Adjusting to the end of the oilboom and the bursting of an asset bubble is a major problem for Kazakhstan, but with its much higher income levels and accumulated reserves Kazakhstan is the Central Asian country best-placed to tighten belts. Turkmenistan has been less exposed to global energy market developments because gas prices are less volatile than oil prices. Turkmenistan under new leadership may also be well-placed to weather an energy-price bust, if better economic management leads to increasing gas output and if pipeline routes can be diversified to reduce dependence on Russian routes.

Grain prices fell in 2008 from a short-term peak. This should help the poorest countries, which are net importers of food. Kazakhstan is a major grain exporter, but Kazakhstan’s farmers benefited in the 2000s from an improved policy environment which left them with a larger share of net revenues.(11)

Figure 1. World Cotton Prices, 2004-9

Source: Cotlook A(FE) index, graph from the National Cotton Council of America at http://www.cotton.org/econ/prices/cotlook-a-indices.cfm\ (downloaded 30 April 2009.)

World cotton prices are of importance to all Central Asian countries, and especially to Uzbekistan, which is the world’s fourth largest exporter. Although world cotton prices fluctuate, there was no clear trend during the 2000s. There was an upturn in 2007-8 but this corrected in the third quarter of 2008.(12)

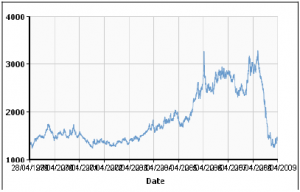

For the region’s gold exporters (the Kyrgyz Republic and Uzbekistan) concerns about a global recession have a positive impact on export earnings. Gold prices, which were languishing around $300 per ounce in the early 2000s, began to surge in mid-decade and as financial concerns mounted in 2007 they rose above $900. Despite a dip in 2008, gold prices have returned to these highs in 2009 (see Figure 2).

Figure 2. World Gold Prices, 1999-2009

Source: Gold Price Australia, at http://goldprice.org/charts/history/gold_10_year_o_usd.png (accessed 27 April 2009.)

Tajikistan’s main exporter is the Talco aluminium smelter utilising the country’s abundant hydro resources. Aluminium exports normally account for over half of the country’s export earnings, although earnings suffered a precipitous decline in 2008-9 as global prices for aluminium collapsed (see Figure 3). Tajikistan should have benefited from surging world prices during the 2000s, but output was often disrupted and whether the proceeds from the smelter benefit the country is unclear. The IMF has publicly stated that data on the flow of funds have been falsified. Talco revenues accrue to a company registered in the British Virgin Islands, and large amounts have been siphoned off by well-connected individuals; a corruption trial is in progress in London.(13) This is symptomatic of Tajikistan’s institutional problems, which make it close to being a failed state.

Figure 3. World Aluminium Prices, 1999-2009

Source: London Metal Exchange at http://www.lme.co.uk/aluminium_graphs.asp (accessed 27 April 2009.)

3. Implications for EU Policy

The implications from the above analysis are that the global economic crisis should have little influence on EU economic policy towards Central Asia. What would have been desirable in the absence of the crisis is still desirable. At the same time, while the impact of the global economic downturn may be comparatively benign in the region, it will raise important challenges that will affect the EU Strategy in the region. Growing unemployment and poverty may increase social tensions and even be the source for conflicts. This suggests that the EU and international organisations should re-examine some of their existing programmes in the areas of poverty alleviation and conflict prevention in light of the changed circumstances

EU members should keep their borders open to imports from Central Asia. The Central Asian countries’ exports remain heavily concentrated in a few commodities, but all governments recognise the desirability of export diversification and this should not be hampered by closed doors in Europe. All EU countries claim commitment to avoiding protectionism, but all are under domestic pressure to protect domestic producers, and weak trading partners are the softest targets. The EU must ensure that members do not undermine European relations with Central Asia by throttling non-traditional export opportunities.

The EU can help Central Asia by living up to its commitment to promote regional cooperation. The BOMCA/CADAP programme, which in its early years focused too much on restricting the drugs trade, now plays an unspectacular, but worthwhile role in improving border management and facilitating trade. Trade facilitation is most vital to the two poorest and most geographically isolated countries, Kyrgyzstan and Tajikistan. Such measures should be in cooperation with multilateral agencies, e.g. through CAREC.(14) The EU can provide a European dimension by supporting initiatives to develop trade corridors such as the E40 Tashkent–Berlin road, which for hundreds of kilometres is little more than a dirt track through the desert.

The EU’s commitment to poverty alleviation in Central Asia requires that resources be made available to Kyrgyzstan and Tajikistan, the region’s two poorest countries and the ones most severely hit by the global crisis. Domestic labour markets in these countries will be destabilised by returning migrants unable to find work in Russia or Kazakhstan. Aid will be necessary to help provide domestic employment and for humanitarian reasons.

Perhaps most imaginatively, the EU could use an era of subdued energy prices to put together a coherent longterm strategy towards energy security and relations with Central Asian producers. It is important to place EU support for specific projects in the context of changing attitudes towards renewable energy and changing technology (e.g. liquefaction technology that may transform the economics of gas pipelines). Nevertheless, the headlines in the near future will concern pipeline routes and their geopolitical undertones; especially where pipelines might be mutually exclusive, as with the Russian-favoured South Stream and the US-backed Nabucco route, it is important to develop a coherent approach in the best interest of the EU and Central Asia.

4. Conclusions

The global recession’s impact has been relatively benign for Central Asia. Kazakhstan, the country most integrated into the global economy and potentially most harmed by the global crisis, is the country best-prepared for negative financial and trade effects. Uzbekistan and Turkmenistan have foregone economic benefits from global integration, but by the same token are relatively insulated from external shocks other than through commodity prices. The Kyrgyz Republic is in an intermediate position, but its major export commodity, gold, often does well during recessions and 2008-9 has been no exception. A more significant transmission for the poorer countries is migration, and the direst negative impact is through the reduced flow of remittances to Tajikistan, the poorest country in the region.

Recession is a threat to Central Asia, as economic hardship may lead to increased repression, challenging the EU’s commitment to human rights and democratisation in the region. However, global recession also presents opportunities. So far the EU has played a minor role in Central Asia. Despite grand overarching statements in the 2007 Strategy and high level meetings in 2008, questions remain about the EU’s ability to deliver on its promises to foster a broad range of engagements with Central Asia.(15) The shifting positions of other interested parties offer an opportunity to change this. China is using the commodity bust to buy into resources. Russia is more subdued than when oil prices were high. The US has a new administration. Iran has upcoming elections. The EU is committed to pursuing the Central Asia Strategy through the Swedish Presidency until the end of 2009, and in 2010 Kazakhstan will chair the OSCE. The EU should keep nimble in these shifting circumstances.

- This EUCAM Policy Brief is part of a miniseries of three publications on the impact of the global slowdown on Central Asia and its relations with the European Union

- See R. Ranciere, A. Tornell and F. Westermann (2008), “Systemic Crises and Growth”, Quarterly Journal of Economics, 123(1); pp. 359-406 provide evidence of a positive relationship between crisisprone economies and growth.

- For more details see The Economies of Central Asia, (Princeton University Press, Princeton NJ, 1995) and The Central Asian Economies since Independence (Princeton University Press, 2006).

- R. Pomfret, “Turkmenistan’s Foreign Policy”, The China and Eurasian Forum Quarterly 6(4), November 2008, pp. 9-34 (available at http://www.isdp.eu/cefq).

- The first substantial foreign investment in the banking sector was in November 2007 when the Italian bank UniCredit paid $2.1 billion for a 91.8% stake in ATF Bank, Kazakhstan’s fifth largest bank.

- In February 2009 the Kyrgyz Republic gave the USA six months’ notice to vacate the airbase.

- See A. Kireyev, The Macroeconomics of Remittances: The Case of Tajikistan, IMF Working Paper 06/2, January 2006.

- For more details see R. Pomfret, “Kazakhstan’s Banking Problems”, Central Asia Caucasus Analyst, 20 February 2008 (e journal available at http://www.cacianalyst.org/?q=issueachive).

- The full amount owed by Kazakhstan’s banks to foreign creditors is unclear. According to the Financial Times, in October 2007 Kazakh banks’ international borrowings totalled $40 billion, and conservative estimates put the banks’ foreign debt due in 2008 at around $12 billion.

- The numbers in this paragraph draw on the Asian Development Bank report Central Asia: Increasing gains from trade through regional cooperation in trade policy, transport, and customs transit (Manila 2006).

- Estimates of producer support to farmers are contained in R. Pomfret, “Kazakhstan”, in Kym Anderson and Johan Swinnen (eds), Distortions to Agricultural Incentives in Europe’s Transition Economies, World Bank, Washington, D.C., 2008, pp. 219-63.

- According to the ‘Cotlook A’ price index, which is the average of the lowest five of nineteen prices for cotton delivered in Asian ports, cotton prices reached a peak at 92 US cents/lb in 1994/95, after which they fell by more than half to 42 cents/lb in 2001/02 before recovering to 68 cents in 2003/04. On 27 April 2009 the index stood at 59 cents.

- See J. Helmer, “IMF blows Whistle on Tajik Corruption”, Asia Times Online, 26 March 2008 (www.atimes.com/atimes/Central_Asia/JC26Ag01.html – accessed 30 April 2009). The London trial, in which Talco is trying to recoup $500 million from two former employees, is estimated to be costing about 5% of Tajikistan’s GDP (“Tajikistan: Aluminum Plant embroiled in Protracted Expensive Legal Case”, Eurasianet, 14 November 2008).

- Central Asia Regional Economic Cooperation (CAREC) involves eight countries and an alliance of multilateral institutions comprising Asian Development Bank, European Bank for Reconstruction and Development, International Monetary Fund, Islamic Development Bank, United Nations Development Programme, and World Bank.

- N. Melvin and J. Boonstra, The EU Strategy for Central Asia @ Year One, EUCAM Policy Brief No. 1, October 2008.